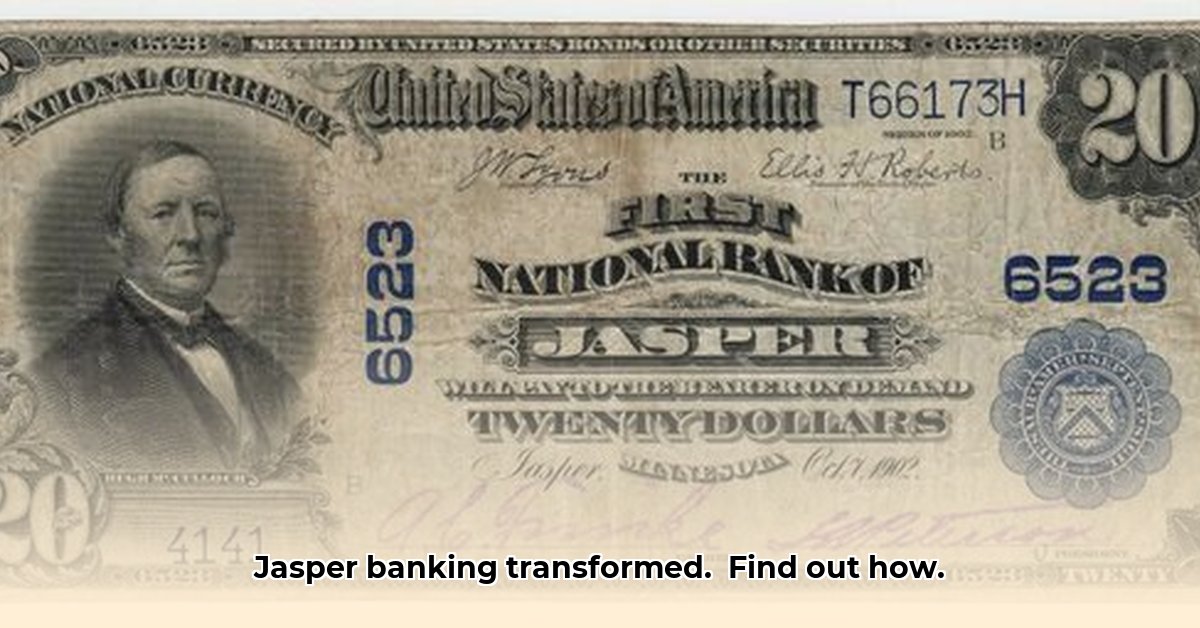

The merger of First National Bank Jasper (FNBJ) and First State Bank of Livingston (FSBL) marks a significant event for Jasper, creating a larger banking institution with combined assets exceeding $700 million. This consolidation promises growth and investment opportunities for the community, but also presents challenges related to integration and customer retention. This article analyzes the merger's implications for stakeholders and explores strategies for mitigating potential risks.

Understanding the Merger: A Look at FNBJ and FSBL

Both FNBJ and FSBL boast long histories of serving their respective communities. Their merger represents a strategic move to combine resources and expertise, creating a more robust and competitive entity in the Jasper area. This isn't simply an increase in scale; it's a potential shift in the local banking landscape, offering expanded services and potentially greater financial stability. The combined entity aims to enhance its service offerings and community engagement.

The Merger's Details: Key Changes and Impacts

The merger's most immediate impact will be a rebranding of the combined institution; a new name will replace the existing brands. The details of this rebranding will influence Jasper’s perception of the merger. Beyond the name change, the merger will involve integrating systems, personnel, and operational procedures. The projected increase in assets suggests a potential increase in investment for community development projects within Jasper. However, the integration process itself poses risks, potentially causing service disruptions and negatively affecting customer satisfaction.

Navigating the Integration Challenges

The integration of two distinct banking entities presents inherent complexities. These challenges include:

Systems Integration: Merging disparate computer systems and data management platforms requires careful planning and execution to avoid service disruptions and data loss. A phased approach, thorough testing, and robust support systems are crucial for mitigation.

Cultural Integration: Differences in corporate cultures—work styles, operational philosophies, and employee attitudes—can impede smooth integration. Proactive steps such as team-building exercises and training programs focusing on collaboration and mutual understanding are vital.

Customer Retention: Maintaining customer loyalty throughout the transition is paramount. Any perceived service disruption or lack of communication could push customers toward competitors. Therefore, strong communication strategies across multiple channels are critical.

Regulatory Compliance: The merger necessitates adherence to all relevant banking regulations. Proactive engagement with regulatory bodies and rigorous compliance processes are essential to ensure a smooth transition with no legal repercussions.

Stakeholder Perspectives and Concerns

The merger's success hinges on the satisfaction of various stakeholders:

Customers: Concerns center around seamless service transitions, maintaining personalized service levels, understanding the new banking processes, and the impact on interest rates and fees.

Employees: Job security, smooth work culture integration, and fair treatment during the transition process are primary concerns. Opportunities for career growth within a larger organization represent a potential benefit.

Management: Successful integration of operations, maintaining profitability, addressing regulatory requirements, and achieving synergies represent key priorities for management.

Risk Assessment and Mitigation Strategies

A thorough risk assessment is crucial for minimizing potential negative consequences. Key risks and mitigation strategies include:

Customer Dissatisfaction: Proactive communication, retention incentives, and readily available customer support can effectively minimize dissatisfaction.

System Glitches: A phased integration approach, rigorous testing, and dedicated support teams will minimize disruptions during the transition.

Cultural Conflicts: Team-building initiatives, training, and fostering open communication channels will facilitate cultural integration.

Regulatory Issues: Proactive engagement with regulatory bodies and careful adherence to compliance processes will ensure regulatory approval and prevent legal repercussions.

How can the bank ensure a smooth transition and retain customer loyalty during this significant change? This is the key question facing the merged entity.

The Future of Banking in Jasper

The long-term success of the FNBJ-FSBL merger depends on effective management of the integration process, a focus on customer retention, and the successful creation of a unified and efficient organization. The increased asset base positions the new bank for potential growth and increased community investment. However, proactive risk management and a consistent focus on customer satisfaction are crucial for long-term success. This merger represents a pivotal moment for Jasper's banking sector, and its outcome will significantly influence the community’s financial landscape.